Global investment is a battlefield, and the United States isn’t waiting for the world to catch up. With supply chains shifting, AI rewriting the rules of manufacturing, and clean energy transforming entire industries, the biggest economy on the planet is in reinvention mode. The opportunity for European companies has never been greater — but the biggest challenge isn’t whether to expand. It’s figuring out where.

Because the U.S. isn’t one market. It’s fifty.

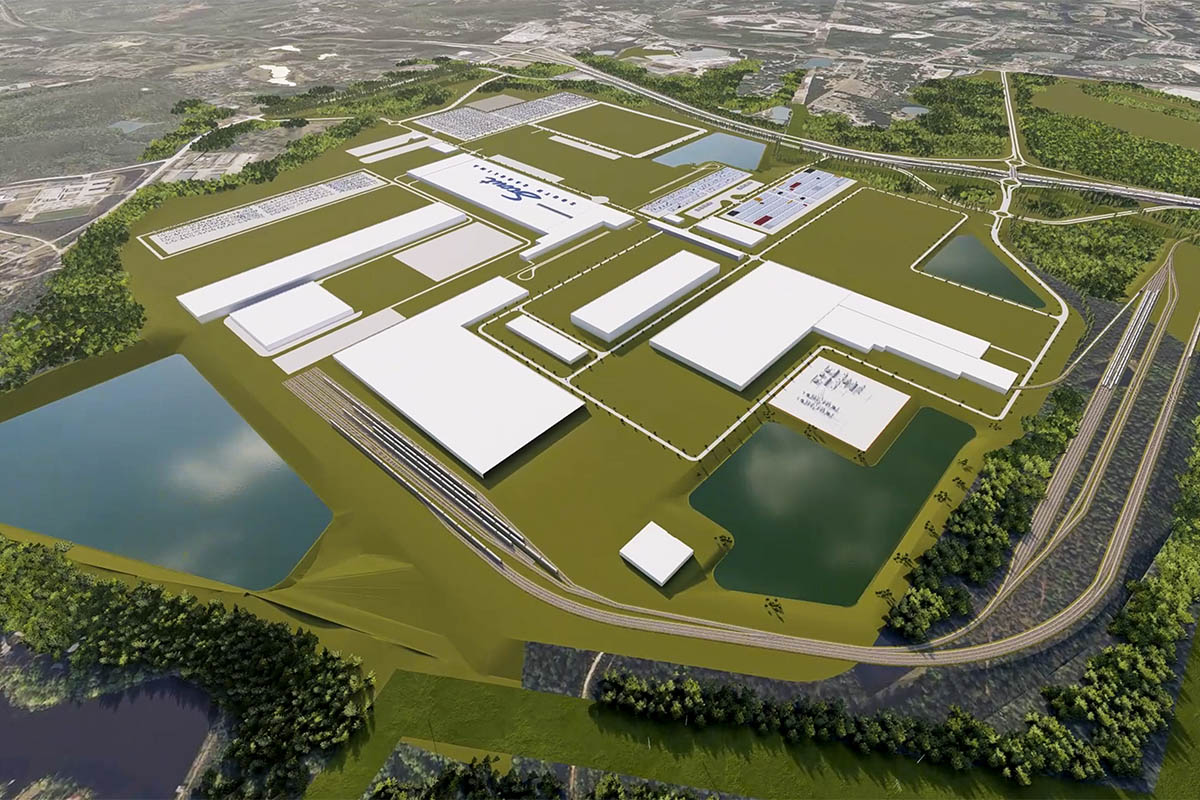

Pick the wrong state, and your billion-dollar investment might as well be a moonshot. But land in the right place, and you’re plugged into a powerhouse — one with tax incentives tailored to your business model, a workforce built for your industry, and an infrastructure designed to scale. That’s where CASE — the Council of American States in Europe — comes in.

It’s been operating quietly for more than fifty years, long before Washington made foreign direct investment (FDI) a priority. It’s not a government agency. It’s not a corporate lobby. CASE is something far more effective: a high-powered, state-driven network that works hand-in-hand with federal agencies, U.S. embassies, and SelectUSA to fast-track investment opportunities for European businesses.

“The United States is the world’s largest economy, but it’s not a one-size-fits-all market,” says Antje Abshoff, President of CASE and Managing Director, International Business Investment, at the Virginia Economic Development Partnership (VEDP). “A company expanding into the U.S. needs to land in the right region — where the infrastructure, workforce, and industry clusters align with their goals. That’s what CASE does.”

Its 19 member states don’t just set up temporary desks at trade shows. They have full-time investment offices across Europe, operating in real-time with investors, industry leaders, and policymakers. Their work is closely aligned with SelectUSA and U.S. embassies, ensuring a seamless bridge between federal resources and state-level expertise.

“The biggest misconception about the U.S. is that it’s a monolithic economy,” says Luigi Mercuri, Vice President of CASE and Managing Director of the European Investment Office for the Economic Development Partnership of North Carolina (EDPNC). “In reality, it’s a decentralized investment landscape. North Carolina leads in biotech and aerospace. Virginia dominates cybersecurity and defense. Illinois is pushing the frontier in quantum computing. Each state is its own ecosystem, and CASE makes sure European companies land in the one that will set them up for long-term success.”

It’s not just about matchmaking. It’s about momentum. CASE is plugged into the forces reshaping the global economy, whether it’s the CHIPS Act triggering a semiconductor arms race or clean energy legislation turning certain U.S. states into the Silicon Valleys of renewables. And because CASE works closely with SelectUSA and the U.S. Commercial Service, its states don’t just respond to investment trends — they anticipate them.

“We recently worked with a European company looking to establish a data center in the U.S.,” Antje says. “Their biggest concerns? Access to carbon-neutral energy, shovel-ready land, and a skilled workforce. We didn’t just tell them where to go — we matched them with the states actively investing in those priorities. While we do not tell companies where to go, we provide relevant information about the states that actively invest in those priorities. That’s the CASE advantage.”

And it’s not just about steering companies toward familiar names. When most European firms think of expanding to the U.S., they default to New York, California, or Texas. But these are not the only locations where the real opportunities are unfolding.

“Many of the best opportunities aren’t where companies expect,” Antje explains. “Take a Scandinavian clean-tech firm. They might assume they belong in California. But what if North Carolina or Georgia actually offers better incentives, lower energy costs, and a thriving clean-energy supply chain? That’s what CASE does — we widen the lens.”

“The U.S. is building the future — CASE’s member states’ goal is to make sure investors land where they’ll thrive.”

Antje Abshoff, president CASE

It’s this precision guidance, backed by collaboration with federal trade and investment offices, that has led to billion-dollar FDI deals across CASE states. Advanced manufacturing, clean energy, semiconductors, aerospace — these aren’t just emerging sectors. They’re the foundation of the next industrial revolution, and CASE is making sure European investors are front and center.

And make no mistake: competition isn’t just between the U.S. and the rest of the world. It’s happening within the U.S. itself.

The fight for investment is fierce,” Luigi says. “States aren’t just throwing around tax breaks anymore — they’re building ecosystems designed to attract the industries of the future. The ones that get it right aren’t just offering incentives. They’re investing in infrastructure, R&D, and education to make sure businesses don’t just set up shop, but stay for the long haul.”

That’s where CASE’s long-term strategy pays off. The next wave of investment isn’t just about where companies build — it’s about who they can hire.

“The biggest conversation we’re having with European firms right now? Talent,” Antje says. “They want to know where the AI engineers are, where the best mechatronics graduates are coming from, where the apprenticeship programs are strongest. In the U.S., states have realized that talent is the ultimate incentive.”

Virginia’s partnership with Amazon’s HQ2 is a prime example. Instead of just offering tax breaks, the state invested $1.5 billion into a new Virginia Tech campus to develop the next generation of STEM talent. That’s the future of investment attraction — long-term thinking over short-term deals.

“The U.S. is evolving fast,” Antje says. “The states that are winning aren’t just cutting checks — they’re building the industries of the future.”

And the opportunity is only growing. With 31 regions now designated as official U.S. tech hubs — and 12 already receiving funding in the first round — states across the country are doubling down on innovation, AI, and clean energy at an unprecedented scale. CASE is in the thick of it, ensuring its states don’t just compete, but lead.

“The next decade of economic growth is being shaped right now,” Luigi says. “European companies have unprecedented access to the most innovative regions of the U.S. CASE ensures they don’t just see America as a market — they see it as home.”

And in a world where agility wins, that could make all the difference.