Why did MasterCard launch a new logo in 2016?

It is important to change the identity of a brand every five to eight years—we hadn’t refreshed our brand in 20 years. We started working on our new logo four years ago, keeping in mind brand recognition as it is critical at any point of sale. If the logo looks different, the experience of the consumers (2.3 billion cards worldwide) is interrupted as they might question its legitimacy. The new logo was launched in July 2016 and had a great reception.

How was the new logo created?

The three elements in our previous logo: colors, overlapping circles and the name MasterCard became the parameters for creating the new logo that had to translate well for today’s audience. It was digitally optimized and there is a very subtle color difference; the new colors are made to stand out more.

After the launch, 81% of people around the world were able to recognize that this was a MasterCard logo owing to the two circles. We will likely drop the name altogether over the next four years.

And now, does it reflect the digital age?

Yes. Times have changed and the world has gone digital. High-tech is the name of the game. We had to become a digital brand and come up with a new logo that was digitally optimal, contemporary, sophisticated, and aspirational without excluding anyone. But at the same time, the new logo had to carry continuity with the past to avoid interrupting the consumers’ experience.

“We were largely recognized as a payments brand, but we are so much more than payments. We are a technology company that can enable payments.”

Raja Rajamannar, Chief Marketing & Communications Officer, MasterCard

Is consumer perception of MasterCard changing?

Today we are 20th on the BrandZ list and 4th most liked brand. Y&R’s Brand Asset Evaluator, which measures brand energy and differentiation, says our scores have been rising steadily each year. Brand perception improves when people enjoy and like the brand. This translates into better business results.

How has the digital revolution transformed MasterCard marketing since you became CMO in 2013?

We are a lifestyle brand that is consumer-oriented so we need to connect with the consumer. To do so we used to focus on advertising, but today consumers don’t want advertisements, digital or traditional, to interrupt their experience.

Therefore, we are using the experiential model. We have extremely powerful sponsorship assets across sports, entertainment, music, arts, shopping, travel and sustainability. We wanted to bring those assets to life so that consumers can interact with them. Instead of telling a story to the consumer, we made them a part of the story. They become storytellers through social media platforms and so we embraced storymaking.

Experiences can be created in any area of a consumer’s life. We are trying to create marketing platforms that will deliver extraordinary experiences in real time to consumers.

How is MasterCard using new digital technologies to improve its marketing campaigns?

Data analytics is not new for us and we have been using it for some time. We are now including big data too, however, we must remain vigilant not to impede on consumers’ privacy. The data we research and analyze is anonymous and aggregated and cannot be linked to an individual consumer.

One of our key differentiating marketing techniques is the ‘Real-Time Marketing Engine’ which analyses social media events in real time and determines if there is an opportunity for us to launch a promotion around them.

We are also interested in messaging as a medium. Messaging applications have grown greatly over the last couple of years. We are trying to work with these without intruding or interfering, but via artificial intelligence chatbots.

“We need to find relevant ways to reach consumers who no longer want advertisements which some find annoying. Each opportunity to interact with consumers must be meaningful and relevant.”

Raja Rajamannar, Chief Marketing & Communications Officer, MasterCard

What can you tell us about the MasterCard Identity Check?

MasterCard Identity Check, more popularly known as ‘selfie-pay’, appeals particularly to younger segments of the market. It is a suite of technology solutions that leverage advanced technologies to prove a consumer’s identity and further simplify the online shopping experience. This is one way to penetrate those market segments because it is fun, natural, and it coincides with their behavior.

What is the role of Mastercard Labs?

MasterCard Labs is our research and development (R&D). We are very lucky to have phenomenal teams at MasterCard Labs. They are the geniuses who look into the future, create new concepts, and provide beta tests. Of course, not every innovation necessarily goes to market.

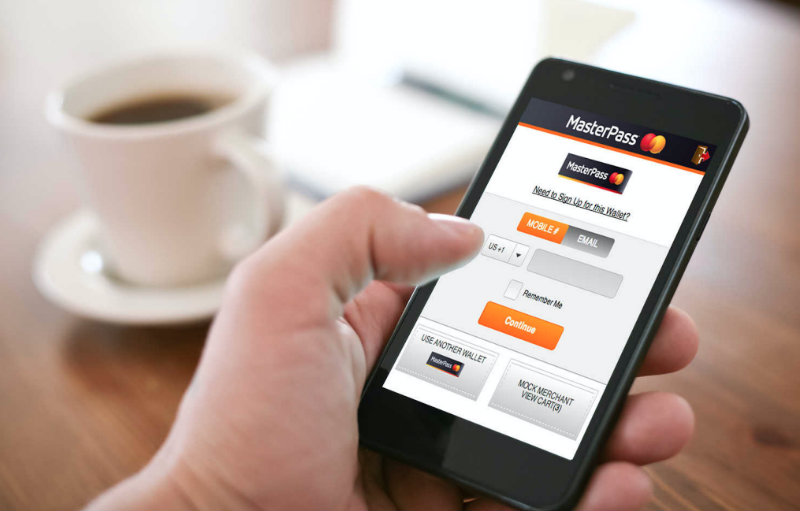

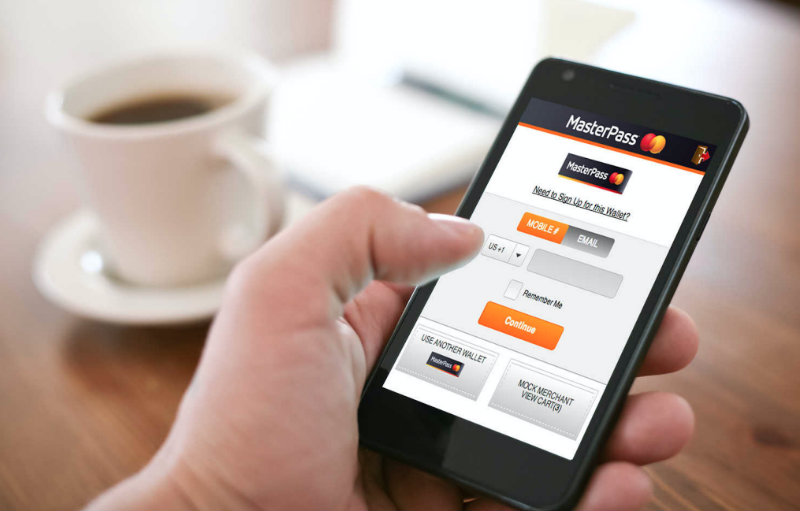

Do you think MasterPass will supersede the MasterCard brand?

MasterPass is our digital brand, a representation of our entire digital efforts. If the future is largely digital, this will be our brand in the future. However, it may not happen in the following 10 years. While there are 2.3 billion cards, the penetration of digital payments is only 15%. We want to have a smooth transition from one to the other—we don’t want the consumer to differentiate between the two brands![]()